Some Of Mileage Tracker

Table of ContentsThe smart Trick of Mileage Tracker That Nobody is DiscussingSome Known Questions About Mileage Tracker.Some Ideas on Mileage Tracker You Should KnowFascination About Mileage TrackerAn Unbiased View of Mileage TrackerThe Best Guide To Mileage Tracker

An online organizer needs to have the ability to offer you a pretty accurate estimate of mileage for the journey concerned. While it may appear like a strenuous task, the benefits of keeping an automobile gas mileage log are tremendous. As soon as you enter the practice of tracking your mileage, it will come to be acquired behavior to you.

Our notebooks are made using the highest possible quality products. If you have any inquiries, don't think twice to reach out - email us at!.

For local business proprietors, tracking gas mileage can be a tedious however essential task, specifically when it involves making best use of tax deductions and managing overhead. The days of manually tape-recording gas mileage in a paper log are fading, as electronic gas mileage logs have actually made the process a lot more effective, accurate, and practical.

The Basic Principles Of Mileage Tracker

One of one of the most substantial advantages of making use of an electronic mileage log is the moment it conserves. With automation at its core, electronic devices can track your trips without needing hands-on input for each trip you take. Digital mileage logs utilize general practitioner innovation to immediately track the distance traveled, classify the trip (e.g., company or personal), and generate detailed records.

The app does all the benefit you. Time-saving: Conserve hours of manual information entry and prevent human mistakes by automating your mileage logging process. Real-time monitoring: Instantly track your miles and produce records without waiting until completion of the week or month to log journeys. For small company proprietors, where time is cash, making use of a digital mileage log can considerably simplify daily procedures and complimentary up more time to concentrate on growing the organization.

Some service owners are uncertain about the advantages of tracking their driving with a mileage app. In a nutshell, tracking gas mileage throughout business travel will help to increase your gas performance. It can also assist decrease automobile wear and tear.

Some Ideas on Mileage Tracker You Need To Know

This post will disclose the advantages associated with leveraging a gas mileage tracker. If you run a distribution business, there is a high opportunity of spending long hours when traveling daily. Entrepreneur usually find it tough to track the ranges they cover with their automobiles since they have a great deal to think around.

In that instance, it implies you have all the opportunity to enhance on that element of your organization. When you use a gas mileage tracker, you'll be able to record your costs better (mileage tracker).

Mileage tracking plays a big role in the lives of many drivers, employees and company choice manufacturers. What does gas mileage tracking mean? And what makes a gas mileage tracker app the finest mileage tracker app?

The smart Trick of Mileage Tracker That Nobody is Talking About

Mileage monitoring, or mileage capture, is the recording of the miles your drive for organization. A lot of full-time staff members or agreement workers tape their mileage for repayment purposes.

It is necessary to note that, while the device makes visit use of general practitioners and activity sensing unit capacities of the phone, they aren't sharing areas with companies in genuine time - mileage tracker. This isn't a surveillance effort, but a much more practical method to catch the service journeys took a trip accurately. A free mileage capture app will be hard to come by

Not known Details About Mileage Tracker

Mileage applications for individual vehicle drivers can cost anywhere from $3 to $30 a month. Our group has decades of experience with mileage capture. One thing we do not provide is a single-user mileage app. We understand there are a lot of employees available that need an app to track their mileage for tax obligation and repayment functions.

There are a considerable variety of benefits to using a gas mileage tracker. For business, it's internal revenue service compliance, increased visibility, reduced gas mileage fraudulence, reduced administration. For professionals, it's mainly regarding tax obligation reduction. Allow's explore these benefits additionally, starting with among one of the most essential reasons to implement a mileage sites tracking app: IRS compliance.

Expenditure repayment fraudulence make up 17% of organization expenditure fraudulence. Oftentimes, that fraud is straight connected to T&E things. Several firms are merely not aware of the fraud since their processes are not able to inspect reports in an automated, efficient fashion. With an automated mileage monitoring application, business receive GPS-verified gas mileage logs from their staff members.

Mileage Tracker Things To Know Before You Get This

Automating gas mileage tracking boosts productivity for those in the field and those active filling out the logs. With a mileage app, logs can conveniently be sent for repayment and complimentary up the administrative work of verifying all staff member mileage logs.

Once more, specialists primarily make use of business gas mileage trackers to maintain track of their mileage for tax reductions. What makes the best gas mileage tracker app?

Ben Savage Then & Now!

Ben Savage Then & Now! Jennifer Love Hewitt Then & Now!

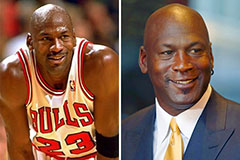

Jennifer Love Hewitt Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!